Find Home Insurance at Lowest Rate and Premium

Buying home insurance is not as easy as buying life insurance. There are more things to consider and more tips to follow to find home insurance at the best price. There is one thing you should know. It’s the fact that you don’t have to pay the full price for home insurance. It means that you can get many discounts as long as you are eligible. It’s never wrong to ask lower premium to the insurance companies because you’ll never know when you can get the opportunity. For instance, with you being faithful customer or customer with good credit, you can get cheaper home insurance. So, there’s always opportunity for you to be saving more money on home insurance.

5 Practical Tips to Find Home Insurance at Lower Premium

Now that you are ready to buy home insurance, get everything started. Contact several insurance companies at once to ask for quotes. Comparison is important because it helps you to find which one is the best for you.

Use the same insurance provider for multiple policies

Is your car insurance company offering home insurance? Why don’t you try to find home insurance from that company too? All insurance companies are more than happy to give you reward for buying multiple policies from them. You can even save up to 30% by buying from the same company. So, this is a really great chance for you to grab. Apparently, it doesn’t only save you some money but also allows you have more consistent service from the company when it comes to handling your claims. And, it will be much easier for you to make communication with the company.

Install home’s advanced alarm system

Actually, buying home insurance is similar to buying car insurance. With car insurance, you can get lower price if your car has advanced safety features. The same thing goes with your house. If your house has advanced alarm system, you will have your premium cut certain percentage when you want to find home insurance. Some of the most common alarm systems to install are burglary system, carbon monoxide sensors and fire alarms. If the alarms are connected to center station, it can actually cut your home insurance premium as much as 10%. It’s possible because your home is under 24/7 monitoring.

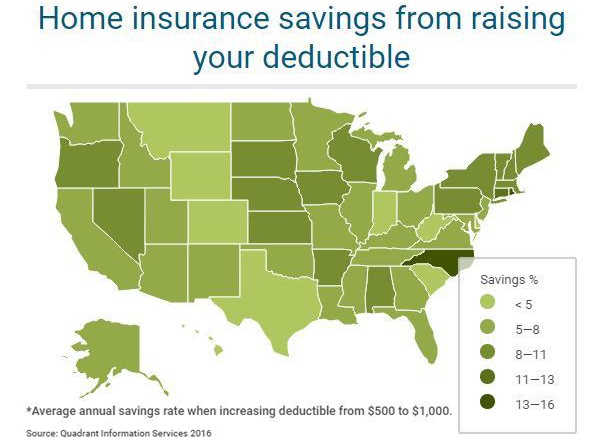

Boost your deductible

When you decide to go with high deductible insurance policy, you will be able to save more of home insurance premium. Just in case if you haven’t known what deductible is, it’s amount of your loss an insurance holder has to make up using his/her own money. It’s usually paid before insurance starts to kick in. If you consider yourself being capable to go with high deductible, do it. This can save you up to 35% of your insurance premium. And that’s a good offer when it comes to find home insurance.

Be faithful customer

Generally insurance companies will give discounts or special offers, to customers who use more than two of his insurance program

Every insurance company expects their customers to be loyal and that includes you. And that’s exactly the reason why a loyalty of a customer can actually earn the customer cheaper home insurance. It can save as much as 5% to 10% for the premiums when you need to find home insurance. But, you should be at least becoming a customer for 3 to 5 years first before you can get lower premiums.

Have good credit

Impress the insurance company with good credit is one of the easiest ways to get discount. High credit score equals to favorable interest rate on various types of insurance including car and home insurance. It also equals to lower premiums. Good credit score means you will be potential customer for the insurance company. So, make sure to keep high credit score when it comes to find home insurance.

So, that is find home insurance at lowest rate and premium. Hopefully, this article can helpful for the readers. Thank you for visit our blog. Do not forget to share this article for helpful the others readers.