Home Remodeling Loans for Perfect House

When looking at all the methods for you to remodel and transform your home, it’s important to check out your entire options for home remodeling loans and reconstruction loans. Your home is an important part you will ever have, something you spend money on and enjoy for a long period.

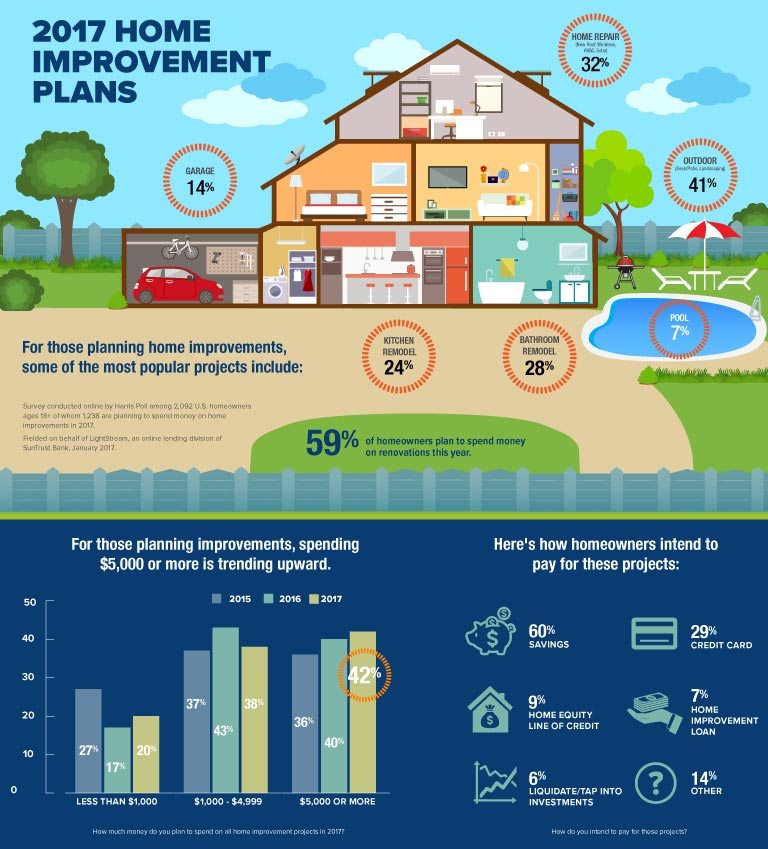

Whether you want to make home vehicle repairs, remodel, buy new devices, use a pool or perhaps furnish your home, an individual loan helps it be easy to fund any home improvement.

Taking good thing about a home improvement loans best rates can truly add joy to running a home and boost your property value. Using personal loans for home maintenance can be carried out without depleting your home collateral.

Whether you are building an addition, making maintenance or updating your bathroom, an individual loan could possibly be the smart way to fund these home advancements. Once approved, your loan is funded and you could use the amount of money nevertheless, you want.

There are Benefits of an Individual Home Remodeling Loans

- A home remodel loan programs may be used to make your home’s value without needing the collateral in your home.

- Unlike a home improvement loans with equity or credit line, an individual loan is unprotected, signifying your home or another property will never be used as guarantee. Keep the collateral at home intact.

- Resolved rates! Get low, set rates with a collection payment schedule alternatively than adding home improvement bills on a debit card.

- More overall flexibility – You should use the loan for whatever you want on your home.

Consider All of Your Options which Means You Can Make the Best Decision. The Next Questions Might Help Get You Started:

- Just how much do you anticipate to borrow because of this project and exactly how long does one estimate it will require to complete?

- Which kind of repayment options fit your financial budget and exactly how long do you intend to try pay back what you acquire?

- Does indeed one-time usage of cash or ongoing usage of credit better fit your home improvement needs?

- Do you intend on finding a contractor to refurbish your home or do you want to complete the job yourself?

Until just lately, borrowing money for a fresh kitchen, second-story addition, or other home improvement designed going to the lender, finding a loan official, and longing for the best. Today, however, you have a lot more options. A home loan broker, for example, may offer more than 200 different home remodeling loan options. And brokerages are one among the countless lenders wanting to come up with a loan that works with your situation–even if your credit score is very poor.

That means you may be able to acquire additional money than you think. But with so many fighting lenders, loan options, and conditions, it does mean loan shopping is often as challenging as house hunting. You are able to neglect all the distress and land on the right loaning program by:

- focusing on how much money you will need and around how much you can get right away;

- narrowing the myriad loan options right down to those that match the needs you have and funds; and

- focusing on lenders that are likeliest to provide the sort of loan you want.

How Much is it Possible to Borrow for Home Remodeling Loans?

Whether you work with a company or undertake the task yourself, get started with a precise estimate of the particular project will definitely cost. Lenders will insist upon a specific body before they use you. If you are hiring a company, start with a company bid, divided into labor and materials. Then increase ten percent for surprises. On work you’ll do yourself, put together an in depth materials list with volumes, costs, and a precise total. Include permit fees and equipment lease. Then put in a cushioning of 20 to thirty percent to be safe. Knowing how much you will need, how much do you want to get? Regardless of the promises and media hype lenders make in their advertising and promotional materials, how much you can acquire depends on your credit history, the loan-to-value percentage, as well as your income. These factors also help determine the interest, the space of the loan, and whether you’ll pay factors. Your credit history. The very best rates and conditions go to homeowners with an A rating–no overdue payments within the last 12 months no maxed-out bank cards. A couple of late obligations or overdrawn bank cards will most likely not knock you from the game, nevertheless, you might wrap up with an increased interest and an inferior loan.